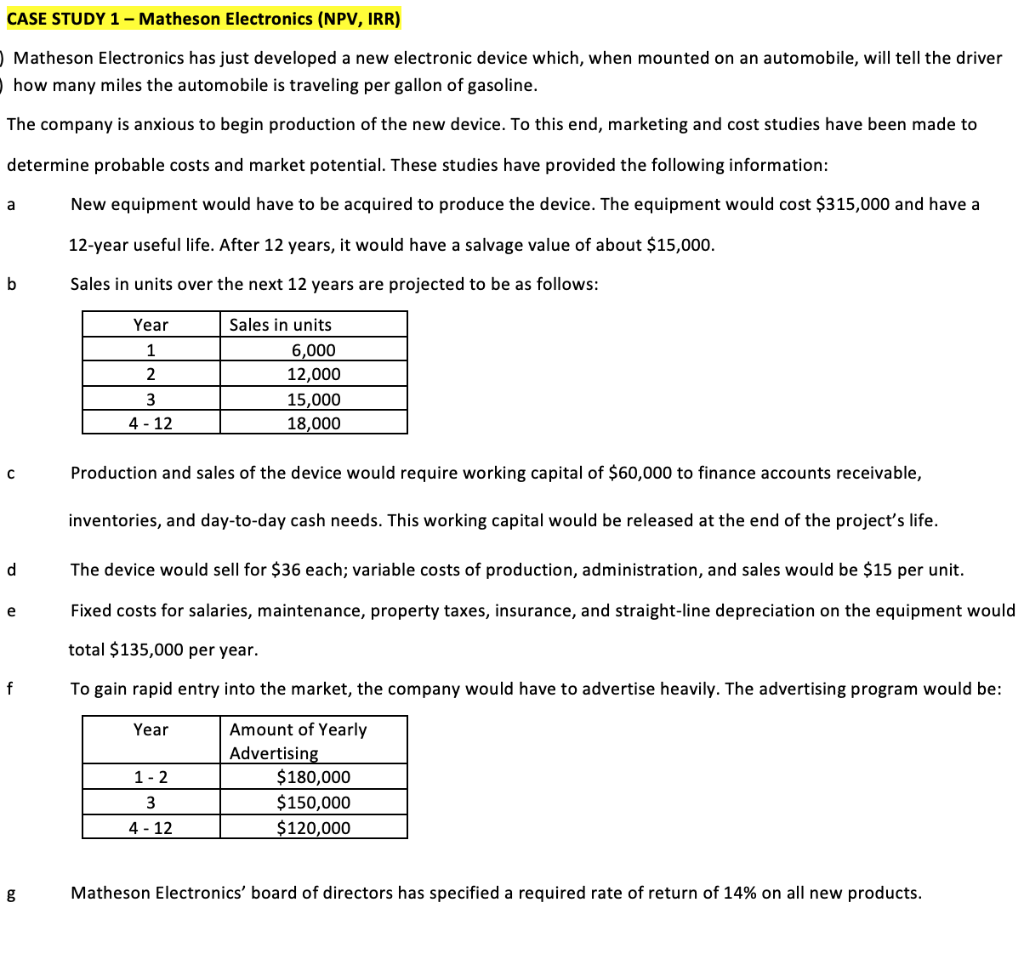

Irr Npv Math

Is considering project d.

Irr npv math. However he found a note that detailed the annual net cash flows expected to be generated by project zeta. The company s cfo remembers that the internal rate of return irr of project zeta is 14 6 but he can t recall how much cute camel originally invested in the project nor the project s net present value npv. Differences between npv vs irr under the npv approach the present value can be calculated by discounting a project s future cash flow at predefined rates known as cut off rates. The irr is the discount rate at which the net present value npv of future cash flows from an investment is equal to zero.

To calculate the npv i did 10 000 3500 1 06 3500 1 06 2 3500 1 06 3 644 46 i used a ti 84 plus to calculate the irr which i got 2 48 so the npv 0 which is the investment would subtract value from the firm and the irr which is 2 48 is less than the 6 cost of capital. Hi guys this video will teach you how to calculate npv net present value and internal rate of return irr in excel. And so the other investment where the irr was 12 4 is better. By contrast the internal rate of return irr is a.

However there is one major difference. Please go to our website www i hate m. Functionally the irr is used by investors and businesses to find out if. So the internal rate of return is about 10.

How to calculate npv irr using microsoft excelby dan way. I should reject plan a 2. At 10 interest rate npv 3 48. However under the irr approach cash flow is discounted at suitable rates using a trial and error method that equates to a present value.

The irr is calculated using exactly the same equation as the npv.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)